The Rise of the Nomadic Office:

Austin’s Commercial Real Estate Market is Being Reshaped

Ask anyone who has been living in Austin for more than 10 years about the city’s growth and you will get a sigh followed by a long and growing list of things that have gone the way of the dodo. Austin has evolved from its former days as a country-meets-hippie town, where legislative aides, musicians and co-eds co-mingled at the Broken Spoke. In the 1990s and early 2000s you might have been able to catch Rusty Wier or Bob Schneider at the Saxon Pub, after getting off your shift at Threadgill’s. You could afford your rent, Longhorn football tickets and after the game, a couple of Mexican martinis on the expansive decks at the Cedar Door on Lamar while you waited to see the next train go by.

Flash forward almost 25 years and things have changed dramatically. There are more people, more cars, less parking, and the growing skyline downtown wasn’t enough so Austin now has two downtowns.

A view of the Austin skyline from Lou Neff Point at Ladybird Lake, formerly known simply as Town Lake.

Austin is also not immune to the changes to the global work patterns that were common prior to 2020. As remote work becomes known as simply “work”, at Haymaker we invite you to explore with us the outlook for Austin employers, companies planning to move to Austin and the commercial real estate market.

What Got Us to Here?

Austin’s population has grown from 596K in 1990 to almost 2.2 million by 2020 with the median household income growing from $16.2K per annum to $75.7K over the past 30 years. This growth is expected to continue and even accelerate until 2030.

The city’s evolution can be attributed to a number of factors that most Austinites are already familiar with: a strong economy (Austin’s unemployment rate is 3.1% compared to Texas’ 4.4%), warm weather and high quality of life. Another factor is the shift in the ways people now work. Technology has been enabling productivity outside of the office for some time but the ubiquity of SaaS applications and advancement in web-based productivity tools has rendered the traditional office as an option rather than a requirement. So, workers are choosing to move wherever they want and Austin is at the top of the relocation list.

There are several reasons that these companies have remained remote-only or transitioned to remote-first.

Austin’s downtown as seen from I-35, a notoriously congested section of the highway.

Unless you’ve been working for the DHARMA Initiative, you’ve noticed a lot of changes since early 2020. This includes the way people live and the way they work. People were already working remotely but that practice was accelerated by the global pandemic. Once employers were able to allow employees to return to their workplaces, employees began to question whether they really needed to physically be in the office. Employers also began to evaluate how much office space they actually required and which employees needed to be in the office every day. This re-evaluation has in some cases resulted in the wholesale abandonment of in-person participation requirements and corresponding office leases. Some companies in specific industries have been successful in justifying an “return-to-office” policy that requires a majority of an employee’s time be in-person but others, mostly in tech-related fields, have been slower to adopt these policies. There are several reasons that these companies have remained remote-only or transitioned to remote-first. It may be because their employees have voiced concern about returning to the office while there was still a threat of contracting Covid or it could be the new-found freedom that a flexible schedule provides employees as they balance work and family obligations. This freedom has also led to some interesting social phenomena such as “The Great Resignation” and “Quiet Quitting“.

Remote Workers and Digital Nomads Find their Haven in Austin

In late 2019, 8% of Austinites worked remotely either exclusively or a majority of the time. By September of 2022, that number is estimated at 38.8%. The average percentage across Texas post-pandemic is 16%. This number has grown more aggressively in Austin due to the larger mix of technology-related jobs, positioning the city as a desirable relocation destination for tech workers. According to Bloomberg, out of 10,000 IT and software employees, about 217 moved to Austin between May 2020 to April 2021. Nashville and Charlotte saw about 154 and 145 tech workers respectively, during the same period. Conversely, San Francisco saw the largest outflows with about 80 tech workers per 10,000 leaving, followed by Boston (54), Chicago (53), Cincinnati (47), and New York City (42).

Austin’s Congress Avenue, Paramount and State Theaters

Employers have noticed and embraced this migration with hundreds of companies relocating or expanding to Austin just in the past six years. Reasons for the trend are not exclusive to employee migration. Texas has long touted its “business-friendly” policies and other factors such as infrastructure, technology and innovation all of which play important roles in an overall business climate.

As of July, 2021, roughly 60 companies announced that they would be moving or hiring about 17 thousand employees to Austin. One of the primary drivers of this expansion to Austin is the expanding population of highly skilled workers which makes for very fruitful recruiting grounds.

While all of these factors lend themselves to being an attractive place to work, there are factors that make living in Austin difficult for workers and there have been migrations out of the city as well, particularly among non-technical workers and families that can no longer afford to buy homes or pay the rental rates that surged during the pandemic.

While Austin has become fruitful recruiting grounds, increasing costs of homes and rental rates are making it difficult for workers to afford the city.

What do employers do when the “return to office” doesn’t fully happen?

So does this relocation and expansion to Austin by employers mean that they are going to be providing office space for all of these new hires? Not exactly. But, it does indicate that employers are a beginning to embrace a different strategy. By having a footprint in multiple markets where their employees are migrating, companies can be more competitive when it comes to employee retention and recruitment of new team members. The strategy can also increase productivity and efficiency by providing an alternative gathering space for remote workers so they can meet from time to time for collaboration and team building. Companies such as Meta have expanded to several locations in Austin including the rental of a WeWork location in the Domain complex in North Austin. (More on Meta’s office utilization plans later).

Employees meet in a conference room in the office. Many may work from the office only a couple days a week, and the remainder they work remotely from their home or a Haymaker space.

Companies are opting for more flexible models offered by on-demand operators like Haymaker. They can expand and contract with the migration patterns that remote work now affords employees.

This approach is different from previous strategies in that employers are not signing traditional office leases. Instead, they are opting for more flexible models offered by on-demand operators like Haymaker. They can expand and contract with the migration patterns that remote work now affords employees. And, since these types of accommodations are available throughout the country, it allows companies to recruit employees based on their qualifications rather than their physical locations.

Before the start of the pandemic, the office vacancy rate in San Francisco was 4%. The city was breaking records with leases signed for 11.9 million square feet in 2018 (the previous record was 11.8 million square feet in 2014). Today, the vacancy rate is 25% and weekly office utilization is down 40% from pre-pandemic levels. Square footage valuations have also tumbled 40% in the same time period. Companies that occupied hundreds of thousands of square feet are now downsizing and subleasing excess space. Salesforce, which occupies and is the namesake for San Francisco’s tallest building, trimmed their space requirements because of downsizing and remote work policies which give employees flexibility around their in-person requirements.

Austin’s downtown as seen from underneath the footbridge at Lamar Boulevard.

So what does this excess commercial real estate inventory mean for the future of the market? It could be scooped up by companies and things go back to the way they were pre-pandemic, but that would assume that the remote work trends have shifted back to pre-pandemic participation rates. In an economy with low unemployment, that is not likely to happen, and future projections estimate that unemployment will stay low in Austin because job growth is expected to outpace the national average.

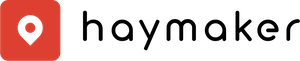

Paul Stanton from PropTech Bankers has an interesting take on what he sees as the future of how office buildings will be occupied and used. In his articles, “A Lazy Guy’s Take on the Future of Office Buildings” and “From 2029: A retrospective on how the global office market was halved, who won, and what we should have been doing in the early 20’s“, Stanton envisions a future where the commercial building usage looks much different from what it looks like today. Instead of primary utilization in the form of company headquarters, Stanton believes it will be a mix of traditional long-term office use, short-term enabled by flex space marketplaces (such as Haymaker) and mixed-use.

This new type of office space arrangement can be described as an “Space-as-a-Service” model where companies and individuals access and use commercial spaces as they need them. Providers of space-as-a-service are already familiar brands. WeWork has been offering spaces in this way for over a dozen years and the coworking concept has been around since 1995. There are over 6,200 coworking locations in the US. Some traditional commercial real estate firms have recognized the new usage patterns of office spaces and have acquired flex work operators. CBRE’s investment in coworking operator, Industrious is a great example of a traditional customer real estate company understanding future space trends and jumping on board.

Are we headed toward a future where commercial building usage is a mix of long and short-term use?

An abstracted view of commercial office space utilization from Paul Stanton’s article “From 2029: A retrospective…”

There are also real estate marketplaces that are putting their own spin on this trend. Instead of leasing spaces, finishing them out and making them available to a remote-work audience, companies like Haymaker are offering spaces that they do not own or manage. These spaces can range from traditional offices to flex spaces to luxury homes and are available on-demand. Marketplaces have the flexibility to open locations with little to no up-front costs and they can expand much faster than traditional coworking locations. This kind of flexibility is important as it’s estimated that coworking will not be able to keep up with remote worker demand.

A team gathering at an outdoor work space. Austin’s mild climate, save the summers, make it a desirable location for companies.

Austin Business Landscape is Growing More Diverse But is Still Tech-heavy

The industries that are relocating and expanding to Austin are diverse and their remote work policies are varied. Tesla is the biggest employer that moved to Austin in 2021. They are estimated to create 5,000 jobs but because they are a manufacturing company and their CEO is a strong advocate for in-person work, only a small percentage of those jobs will be remote compared to other industries. Amazon is the second largest employer with 2,000 jobs but almost all of those roles will be performed in-person at distribution centers. Samsung Semiconductor is also expanding their workforce with 2,000 additional jobs and those will be a mix of in-person and virtual. Quotapath rounds out the top 4 with 1,500 jobs and these will be a mix of in-person and virtual.“Remote work” becomes simply just how we work, and use of a third space becomes commonplace.

A sample work week with days working from home and from a Haymaker space.

Austin’s Future is Bright, so Keep Those Shades Handy

So what does the future look like for Austin? It’s unlikely participation numbers in remote work will sink back to where they were before the pandemic as “remote work” becomes simply just how we work. Employers have hired more remote workers than ever before and to ask them to relocate to cities where headquarters or satellite offices are located is a stretch. In fact, the ability to work remotely is causing more individuals to quit their jobs and pursue fields of work that they’ve never explored before. This trend began during the pandemic and continued as part of The Great Resignation.

Austin is well positioned to continue to benefit from this trend. According to Opportunity Austin, the economic development arm of the Greater Austin Chamber of Commerce, 7,669 new jobs have been pledged to the Central Texas area. It is not clear how many of these new positions will come with proportional, full-time office accommodation but given the competition for new talent and the flexible schedule requirements from many applicants, it stands to reason that many of these roles will be filled by remote workers.

Current residential real estate trends must change to accommodate the needs of Austin’s growing population and economy. It’s estimated that for every new tech job, another 4.3 services and local goods jobs are created. Some of those jobs are well-paying like dentists and lawyers, but others are in lower-wage ranges such as food services or housekeeping. Accommodating all of these new workers will require an affordable alternative to what is available today. This means more advancement in 3D printed homes and more multi-family projects.

Teammates meet for some face-to-face time. A Haymaker space provides a convenient location.

And, if employees are coming to the office only a portion of the week, it’s difficult to justify the expense for some employers to redesign their offices. This is where an on-demand, as-needed approach makes more sense. All signs (including the marquee at El Arroyo) point to remote work continuing to be a major factor in wrapping lifestyles around work instead of the other way around into the next decade. This should continue to keep home prices steady and rising in Central Texas. Investment in the commercial real estate sector will continue as well but, it will be with different use patterns than prior to the pandemic. Would we have arrived at this place without it? I guess we’ll never know.

Haymaker, headquartered in Austin, Texas, provides professionals across the US exceptional space to get their best work done. From larger spaces that facilitate team gatherings to quiet spaces fit for solo, deep-thinking tasks, Haymaker is changing the way we think about going to work.

Looking for meeting space, office space, flexible on-demand work space, or a place for your next work or offsite event in Austin, Texas? Search for the perfect space for you at haymakerspace.com